The Ultimate Guide To Probate Cash Loan

These situations may create probate to be longer than standard. Rather, you need to ask if a probate advancement is a great suggestion for YOU. Probate advancements or inheritance developments aren't excellent or bad by themselves.

Fascination About Advance Inheritance

Assume there is a $15,000 balance on a charge card with a rates of interest of 20 percent. For basic objectives, we will determine the annual rate of interest at $3,000, or 20%, instead of assuming month-to-month settlements. You obtain a probate advance of $15,000 and settle that credit history card, saving you $3,000 annually.

You settle the credit scores card ($18,000 balance), leaving you with $12,000 internet. From a financial viewpoint, it would certainly have been better to wait, however there is a psychological toll financial debt has. A probate advance can be an alternative to clear on your own of financial obligation and also rest better in the evening. Estates with properties, like actual estate, are most likely to drag on than easy estates.

Take a well balanced market. A well balanced market is usually defined as 6 month absorption rate, or the time it would certainly take to sell all of the existing houses given the present sales price.

The Greatest Guide To Probate Advance

Considering the regulations of supply and demand, probate houses often tend to take longer than the average. This is because of the problem of the home. It's commonly obsoleted. Picture you are the heir to an estate in probate where a home more tips here requires to market. Selling a probate residential or commercial property could take you approximately 9 to one year.

Working with a property company, like the Dolinski Team, we recognize with the court of probate, its procedure, as well as usual speed bumps. We know just how to finish a fast probate sale in Michigan. While there are no chances of obtaining around the legitimately mandated steps and demands, we can relocate faster and better sooner than your typical company.

The 9-Minute Rule for Probate Cash Advance

This will certainly take some time, but enables you to optimize the value of the estate. Nonetheless, if you're thinking about a cash breakthrough, consider getting all celebrations to consent to sell the house for money rather. At the Dolinski Group, we make money deals to certifying homeowner in our solution locations.

Plus, you will certainly usually walk away with even more of your probate profits than if you worked with a probate breakthrough business. Example: Sally is established to acquire $75,000 as well as the probate advancement will certainly offer her $22,500.

Her brother or sisters consent to offer the residence for cash and she gets $25,000 of the $60,000 interest in home. She still obtains her $15,000 in cash, as well, bringing her total amount to $40,000. Provided, this alternative will still take time. probate loan. It isn't very same day funding, but browse around these guys it's an alternative option. It's a center ground between waiting on probate to close and also obtaining same day money advancement.

Probate Loan for Beginners

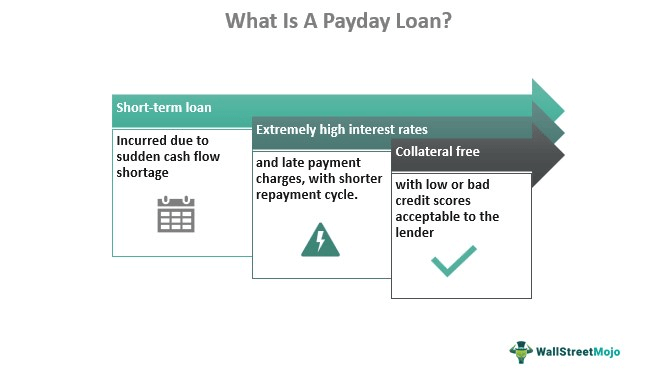

These are certainly the main pros and cons of probate breakthrough. Anticipate to obtain rapid financing, yet expect it to be at a high cost.

The time it takes to shut probate will differ based on the estate. An estate that consists of he said an acquired residence can take a lengthy time to offer and will come to be dependent on exactly how the genuine estate market is doing.

Make an educated decision that you think is the ideal for you. These advances aren't for everybody, yet they can be a practical alternative depending on your situation. If your estate consists of genuine estate in Michigan, obtain in touch with us.

To find out that acquires the possessions of the person that passed away, consisting of residential property for which no recipient has been officially called (such as a home), state law determines who is to obtain the building. Every state has "intestate sequence" regulations that shell out residential property to the departed person's closest relatives.